Nevertheless, price moves imply a severe curtailment of oil demand in the short term. This view may well moderate in the coming days and weeks and as the scientific community begins to glean the salient information about the variant that the market needs to be able to price its impacts. There is also the potential for response from OPEC+ with changes to planned production hikes a possibility (but by no means a guarantee yet).

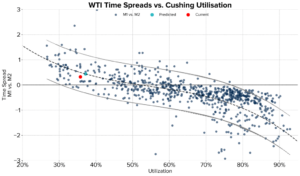

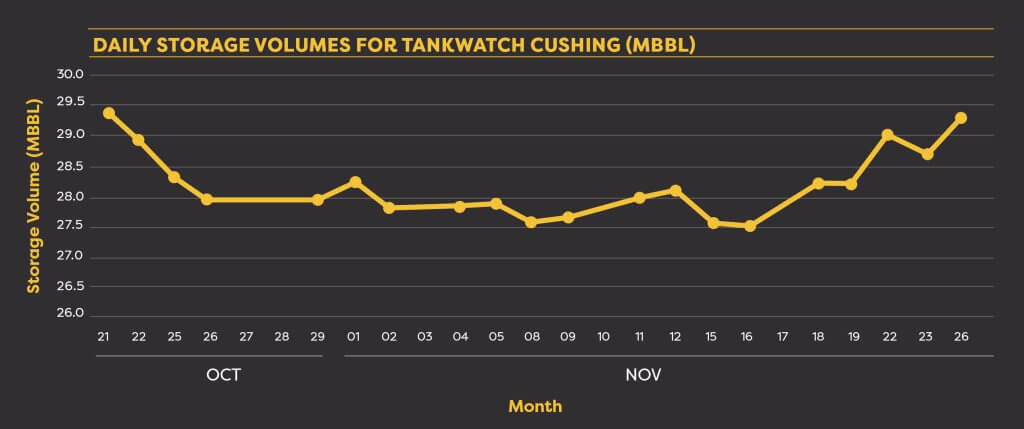

As for timespreads at Cushing, from a pure storage perspective the cumulative correction seen over the last week or two has essentially normalised spreads back from the highly elevated and more towards what can be expected from the physical reality (see chart). There is no doubt that momentum had anyway started to shift away from more implied draws (and potentially running into the issue of tank bottoms) towards a levelling out of inventory, something that we had pointed out as a strong possibility several weeks ago. Indeed, GSI has already captured two consecutive w-o-w builds at Cushing this month, while today’s readings already point to another sizeable build for last week of over 1 million barrels.

The bearish shift was also gathering steam from persistently rising US covid cases and the potential for Europe’s current struggle with the virus to migrate across the Atlantic. That could yet dampen what have been in recent weeks some remarkably strong readings for domestic gasoline demand and moderate the outlook for US crude intake in the weeks ahead. As usual, watch this space for the highest frequency data in the market for Cushing inventory, and get ahead of price moves as the market situation rapidly unfolds.

This article was written in collaboration with Neil Crosby, OilX.

Neil Crosby has a decade of experience in oil and gas consulting and currently works a senior analyst at OilX. His work has focussed heavily on market analysis and price forecasting, in particular on the downstream oil sector.